child tax credit october 15

You could also file a tax return to get the full monthly child tax credit payment youre owed. Regular advance payments of the Child Tax Credit refund were distributed to families on or after July 15 August 15 September 15 October 15 November 15 and December 15.

Let S Find Out Why October 2020 Is Important For Gst Compliance Task Task Compliance Indirect Tax

Ad The new advance Child Tax Credit is based on your previously filed tax return.

. In October the IRS delivered a fourth monthly round of approximately 36. The credit is being issued in installments of up to 300 per month. When does the Child Tax Credit arrive in October.

July 15 August 13 September 15 October 15 November 15 and December 15. The IRS will issue advance Child Tax Credit payments on these dates. July 15 300.

Families that filed their tax returns before July will receive six. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of 3600 per child under 6 and 3000 per child up to age 17. Checks will be sent out from October 15 and should arrive in bank accounts within days.

15 is the last day for families who dont file taxes to register online. However it should be noted that families with college-age dependent children ages 18-24 will still be able to receive a one-time payment of 500 as extra help. Its not too late for low-income families to sign up for the credit.

First families can expect some treats since the fourth round of. Claim about the IRS monitoring bank. For any family that is eligible to receive the tax credit they will need to submit their filed tax return for 2019 or 2020 income statements such as their W-2 and 1099 and the amount of any expenses of adjustments to your income the IRS.

With three monthly payments already issued -- and three more to go this year --. This first batch of advance monthly payments worth roughly 15 billion reached. Families were eligible to receive up to half of their expected tax credit as advance payments equaling regular payments of between 250 and 300 per child.

In a statement the IRS said that 15 billion of payments were sent to about 36 million families. 15 is a date to watch for a few reasons. As a result on October 15 families will receive 300 for each child aged five and under and 250 per child ages six and over.

If your December child tax credit check or a previous months check never arrived well tell you how to trace it. First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are scheduled to arrive Oct. 150000 if married and filing a joint return or if.

On October 15 the following payment of the tax credit for children was sent. Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. The child tax credit scheme was expanded to 3600 from 2000 earlier this year.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. The IRS will send out the next round of child tax credit payments on October 15.

The actual time the check arrives depends on the payment method and. Most of us really arent thinking tax returns in mid-October. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15.

15 the IRS sent the fourth of six monthly child tax credit payments. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

October 15 Deadline Approaches for Advance Child Tax Credit. The IRS sent another round of monthly child tax credit payments on October 15. Most families received their payment by direct deposit.

Who will get the Child Tax Credit. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. IR-2021-201 October 15 2021.

The advance is 50 of your child tax credit with the rest claimed on next years return. IR-2021-211 October 29 2021 On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit payments to update their income using the Child Tax Credit Update Portal CTC UP found exclusively on. IRS Statement Advance Child Tax Credit October payments.

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Advanced Payment Option Tas

Welfare Myth Two Benefit Fraud Is A Big Problem Universal Credit Operant Conditioning Social Control

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Tax Help Online Jobs

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes

Childctc The Child Tax Credit The White House

Parents Guide To The Child Tax Credit Nextadvisor With Time

We Set Up An Offshore Company In A Tax Haven Tax Haven Offshore Hacking Books

Fillable Form 1040 2018 Irs Tax Forms Income Tax Return Irs Taxes

Literacy Rate High School Education Education Level

The Historic Effect Of The Expiration Of The Production Tax Credit Wind Power Climate Change Solutions Power

Neil Henderson On Twitter Cyber Attack Art Of Persuasion Financial Times

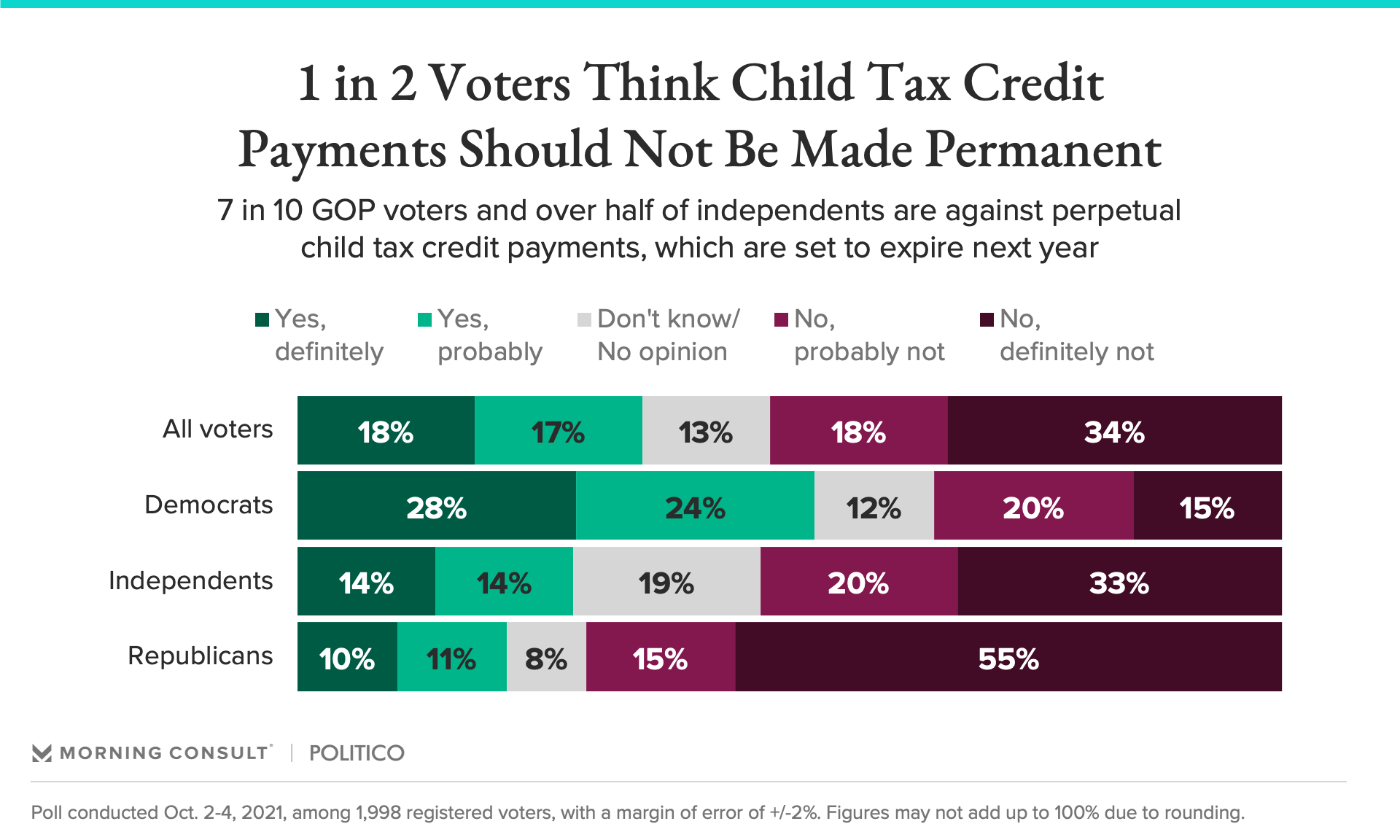

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Blackrock Pushes For Separation Of Powers At Tesla Tesla Technology Updates Tesla Inc

Corporate Venture Capital How The Expectations Of Big Ships And Small Pirates Converge Hec Paris Startup Entrepreneuriat Entreprise